What To Look Out For In Payroll Software For Sme Business / The Best Payroll Services You Should Consider Using In 2021 : We are the first choice payroll services for small businesses in singapore.

What To Look Out For In Payroll Software For Sme Business / The Best Payroll Services You Should Consider Using In 2021 : We are the first choice payroll services for small businesses in singapore.. We are the first choice of payroll services for small businesses in singapore. Let's walk through the four most important things to ask yourself when choosing a payroll provider for your small business. Payroll service revolves around paying employees on time and meeting all legal obligations. We will present the 20 best accounting software for small business as determined by our experts. Take a look at the following ten best free accounting software.

We asked small business owners and sme bookkeepers to tell us what payroll management software they use, and why. Here's how payroll software can solve three major headaches for your sme. Our payroll system software will keep pace with the growth of your business. Here are the top 16 benefits of payroll software and how your startup or sme can benefit by adopting a payroll software. Sage salary and supplier payments, powered by modulr, will help smes save time and money processing payroll and invoice payments.

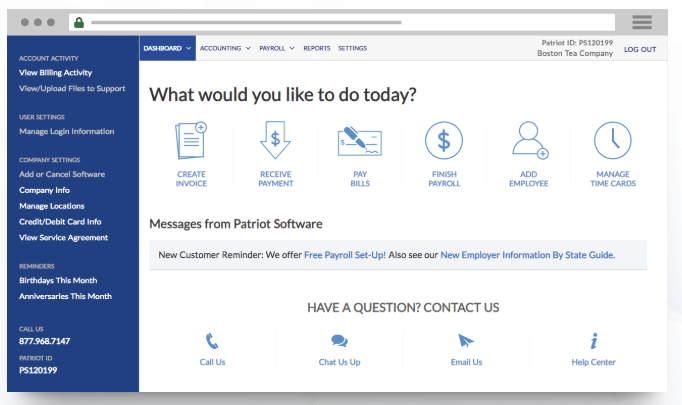

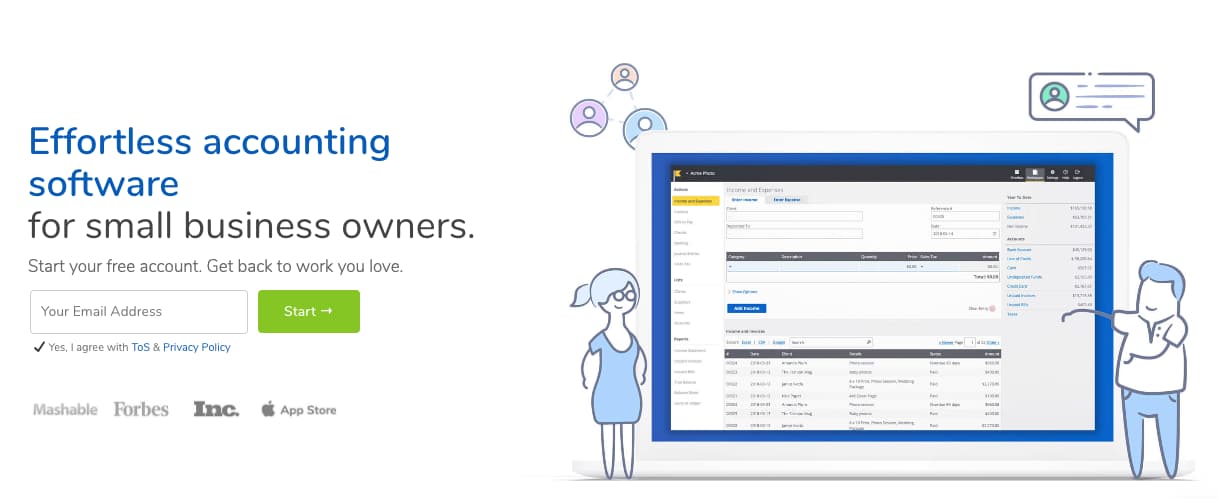

Many of these solutions are more similar than different, hosting standard features like general ledger management, invoicing, and payment processing.

Perfectly tailored to cater to the growing needs of smes!! Besides saving time, less hassle and making fewer errors the benefits of using the most suitable payroll tool can be extensive. We are the first choice of payroll services for small businesses in singapore. Also as mentioned on the website, it can be run 24/7 from any location with an internet connection, and also offers time and attendance and hr software solutions. It boasts of 1lac+ smes in its network who have interacted with smejoinup for their service requirements. Payroll service revolves around paying employees on time and meeting all legal obligations. Let's walk through the four most important things to ask yourself when choosing a payroll provider for your small business. Their features, benefits, and pricing will be discussed. 10 signs to look out for in the right cloud payroll software as a business we understand your recurring need to outsource various business services. Why sme's desperately need a payroll software. Proper payroll data syncing and processing. Here are the top 16 benefits of payroll software and how your startup or sme can benefit by adopting a payroll software. Not only because there's money going out of your business, but because of the administration and pressure to comply with all the tax.

We've picked out four examples of payroll software that may be the perfect fit for your small business. Payroll gets automated as well as seamlessly integrated with attendance and time management, allowing hr to focus on core business issue and not always be stuck with administrative work. Sage salary and supplier payments, powered by modulr, will help smes save time and money processing payroll and invoice payments. Mypaye (free trial, from £1 per month, per employee) if you're already using the popular xero accounting platform, mypaye integrates seamlessly into it by taking data from xero to aid payroll processing. Payroll service revolves around paying employees on time and meeting all legal obligations.

Mypaye (free trial, from £1 per month, per employee) if you're already using the popular xero accounting platform, mypaye integrates seamlessly into it by taking data from xero to aid payroll processing.

Do put up your requirements and let us get quotes for the requirement from our vendors and share it with you. With one such payroll solution by your side, you can streamline and automate calculations, payments, and filings of your business's payroll taxes as well. Many of these solutions are more similar than different, hosting standard features like general ledger management, invoicing, and payment processing. Payroll service revolves around paying employees on time and meeting all legal obligations. We will present the 20 best accounting software for small business as determined by our experts. After reviewing nearly every provider out there, i've learned that a few things can make or break your payroll experience. Proration of salary for incomplete months of work (typically for new hires or departures). Proper payroll data syncing and processing. Choosing the best payroll software for small business which is the best small business payroll software for you will depend on factors such as your company's size, the level of technical support you need, the accounting software you currently use and whether your staff are salaried, paid by the hour, or receive a commission. Many employees live paycheck to paycheck. Small businesses spend way too much time doing payroll every month. Here's how payroll software can solve three major headaches for your sme. Take a look at the following ten best free accounting software.

We are the first choice payroll services for small businesses in singapore. Proper payroll data syncing and processing. This post has been updated for 2020. Payroll service revolves around paying employees on time and meeting all legal obligations. Our payroll software will keep pace with the growth of your business.

We asked small business owners and sme bookkeepers to tell us what payroll management software they use, and why.

This post has been updated for 2020. So check to make sure your employee management software, your pos, and/or bookkeeping software integrate with whatever small business payroll service you choose. Besides saving time, less hassle and making fewer errors the benefits of using the most suitable payroll tool can be extensive. It boasts of 1lac+ smes in its network who have interacted with smejoinup for their service requirements. In addition to saving time and cutting costs, a good payroll system will increase accuracy and decrease risk. Also as mentioned on the website, it can be run 24/7 from any location with an internet connection, and also offers time and attendance and hr software solutions. Common practice is to use work days in a month for calculation. We are the first choice of payroll services for small businesses in singapore. Proper payroll data syncing and processing. The human resource is one of the most powerful tools that the management has for the business. Choosing the best payroll software for small business which is the best small business payroll software for you will depend on factors such as your company's size, the level of technical support you need, the accounting software you currently use and whether your staff are salaried, paid by the hour, or receive a commission. Not only because there's money going out of your business, but because of the administration and pressure to comply with all the tax. Vendors are turning out more solutions, and businesses are buying them.

Komentar

Posting Komentar